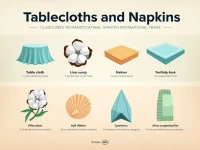

A Comprehensive Guide to Classifying Fabric Products HS Codes for Tablecloths and Napkins

This article provides a detailed analysis of the HS codes for fabric products such as tablecloths and napkins, explaining their definitions, significance in international trade, and classification criteria. It offers the main HS codes related to table use fabric products and emphasizes the need to consider factors such as purpose, weaving method, and material when classifying. Finally, it reminds readers to adhere to local customs requirements to ensure accuracy.